What I Shared on Capitol Hill: Military Spouse Small Business Support Needs

The experiences I've had as a result of being a fierce career-driven military spouse make the challenging journey so worth it! This week's trip to D.C. was no exception. Meta handpicked about 100 small business leaders to meet with policymakers, share how we use digital tools in our business & advocate for our individual small business needs.

Since we're currently stationed in Delaware, I represented DE alongside Bennett Orchards, a local family-owned farm. On top of attending a whole day of programming that Meta provided us, we got to network & visit Senator Chris Coons office. I, of course, came prepared with a 3-minute overview, a small packet of data & follow up resources, should the Senator's team want at-a-glance & additional information. 😉

I was blown away with how the senators team listened, took notes & genuinely cared! It's my hope by sharing the information below, that others will take action to support the future of military spouse small business owners.

As a seasoned military spouse of nearly 15 years, these advocacy efforts are not about me, but for every military spouse who's been told or will be told to give up on their career because having one is simply "too hard."

Since many have asked me to share, here's my take on how we can better support future military families' financial health & what I came prepared to share on Capitol Hill:

Hi, I’m Louise Valentine, Army spouse, best-selling author & industry-leading health & fitness expert. I own Breaking Through Wellness, where I provide coaching & education for women over 35. 20 years into my career, I’ve been named the #1 health educator in the U.S., a top 10 performance coach & just this year, #1 practitioner in the world by the American College of Sports Medicine.

The challenges that military spouses face are daunting & my story is no exception. We’ve moved over 9 times. I’m proud to have been employed at each duty station, but most military spouses can’t say this, as our nation’s military spouse unemployment rate typically falls 4 times higher than the national average.

For example, I left a thriving business with the NFL in 2010 when we relocated to Fort Drum, NY. My professional license did not transfer due to a 5 year reciprocity rule. I was told in order to practice in my field, I would have to take basic college classes over again. I put in over 30 resumes for various positions & I didn’t get a single call back, as a hiring stigma against military spouses, no matter how credentialed or talented we are, exists. I then set up my own business, but by the time I networked & acquired 2 customers, it was time to move.

After watching my income go from $200+ per hour to $7.50 per hour, I earned over 15 degrees & credentials just so my resume would have a fighting chance. While I stand before you today as a leading expert in my field, the reality of trying to juggle traditional employment was simply too much stress on my personal health & our family’s well-being.

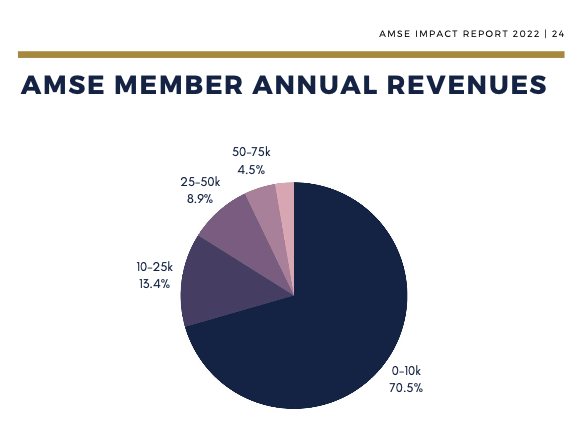

I went back to full-time entrepreneurship in 2020, with a hybrid virtual & in-person business. With relocation inevitable, a traditional brick & mortar business simply will not work. While military spouse entrepreneurship is on the rise, we need more support. In fact, 70% of military spouse small businesses make less than $10K per year (2). Digital tools, like Facebook, Instagram, targeted ads & having an online presence are essential to our success. For example, I coach individuals throughout the world!

As a result, my family has a consistent income & this year my Army O5 husband decided to stay in the military beyond 20 years & compete for command. This is huge, as our Army retains a multi-degreed, talented leader! If my business or our financial health were suffering, he would be leaving the Army to work in the private sector, as most Officers do at this critical career decision point.

While Meta provides great support to our military spouse community, we need the support of policymakers & leaders, too. Currently there is not much to support & highlight military spouse business owners. Ideas include military spouse specific small business grants, state tax exemptions for both military & military spouse earned income (similar to the state of Ohio Military Spouse Residency Relief Act) & support for effective implementation of the Military Spouse Licensing Relief Act, which will provide us exemption from state licensing reciprocity rules.

I think of the impact my career has had on improving the health & fitness of communities, companies & 1,000s of individuals throughout the U.S. It’s my hope that with more support, other military spouses’ careers can thrive & not simply hang on for dear life trying to survive.

2016, Writing my Masters thesis with a newborn, 3-year-old & husband away at training.

2023, Team Valentine stepping into senior leadership with pride & grit.

RECOMMENDED RESOURCES TO LEARN MORE

Excerpt: “The short duration of a military spouse’s stay in a State, coupled with lengthy relicensing requirements, can be sufficiently discouraging to prompt a military spouse to quit an occupation or cause a military family to leave the military. The former outcome can be costly for the military family and the latter circumstance can be costly for the Service.”

“Barriers to the transfer and acceptance of certifications and licenses that occur when State rules differ can have a dramatic and negative effect on the financial well-being of military families. Military spouses routinely lose 6 to 9 months of income during a military move as they try to reinstate their careers. And, as with civilian families, military families depend more and more on two incomes. Differences in licensure requirements across States limit advancement or deter reentry into the workforce at a new location. Removing these barriers, creating reciprocity in licensing requirements, and facilitating placement opportunities can help a military family’s financial stability, speed the assimilation of the family into its new location, and create a desirable new employee pool for a State (especially in education and health care).”

My business was no exception, falling into the less than 10K category in 2020 when rebuilding my company.

Excerpt: "In 2022, Senators Kolbuchar and Tillis introduced the Bipartisan NDAA Amendment, "The Enhancing Military Spouse Entrepreneurship Act" to Support Military Spouse Entrepreneurship. Although the amendment did not get picked up, AMSE is well on its way to raising awareness of issues military spouse entrepreneurship continues to encounter."

- Example helpful national regulation: “Military Spouse Licensing Relief Act”:“January 2023, President Biden signed into law the Military Spouse Licensing Relief Act, amending federal law to improve the portability of military spouses’ professional licenses issued by states.”

- Example of a “Military Spouse Residency Relief Act” that has been helpful to our family, given Ohio is our home state of residence: “Both your income and the military income earned by your spouse in the military are free from taxation in the duty station state. Both spouses are subject to tax (income and property) in their home states.”

Join my weekly newsletter with simple science-based strategies & get our free nutrition guide to maximize your health, fitness & running despite changing hormones!